Your Path to Homeownership — Tracked and Simplified

Save, organize, and monitor your mortgage progress in real time. Know exactly where you stand — and what's next.

Join our waitlist

Your Mortgage Progress

Updated today

Colin, you're 6 months away from your saving goal of $45,000 towards your downpayment

Current Savings

$33,750

Target

$45,000

Monthly Contribution

$1,875

Next Steps

- Continue monthly savings of $1,875

- Upload proof of employment (2 recent pay stubs)

- Complete credit score check

Buying a home shouldn't be confusing.

We break it down step by step, making the journey to homeownership clear and achievable.

Set your homeownership goal

Define your target home price and timeline to create a personalized plan.

Track your savings

Monitor your progress toward a down payment with visual tracking tools.

Upload documents

Store all your important documents lenders need in one secure place.

See your readiness

Get a real-time score showing how close you are to mortgage approval.

Tools designed for your success

Everything you need to navigate the homebuying process with confidence.

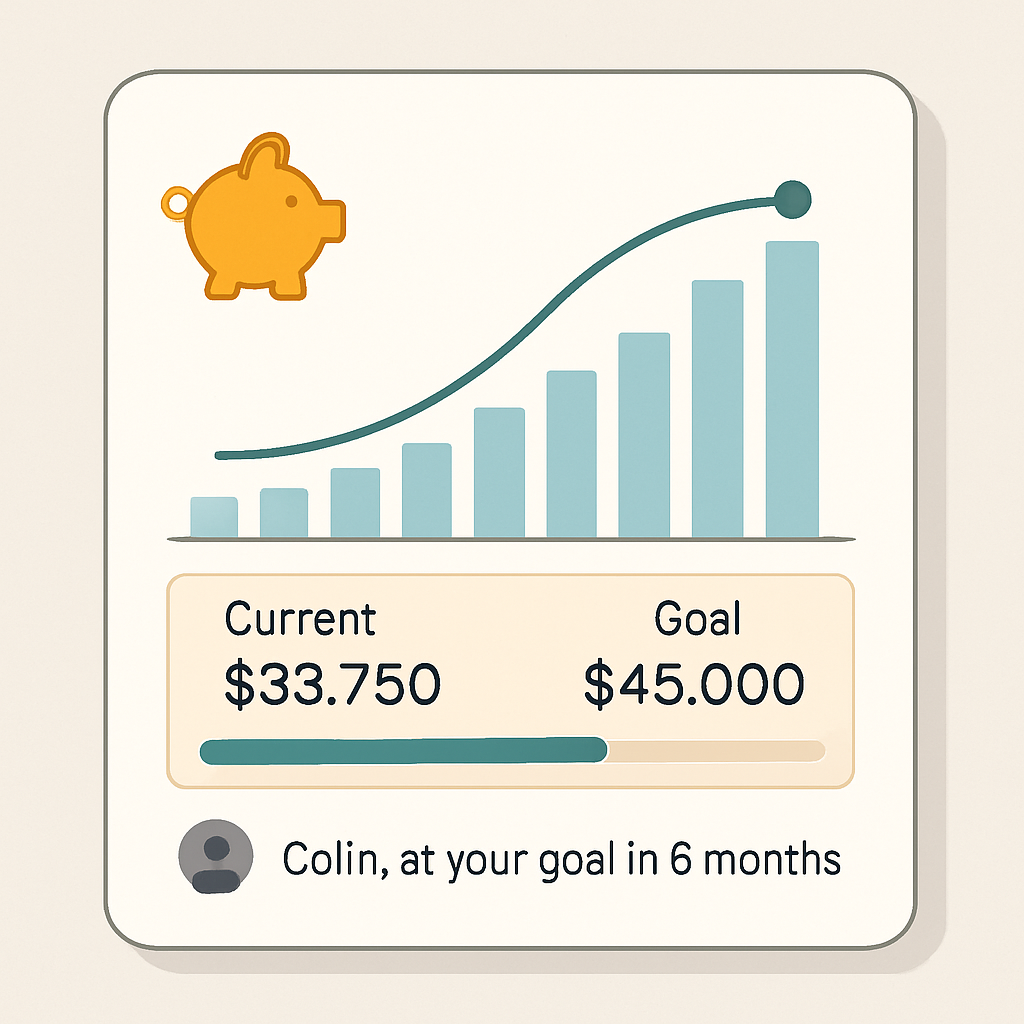

Savings Tracker

Set your home price goal and monitor your savings progress with visual charts and milestone alerts.

Colin, at your current rate, you'll reach your goal in 6 months

Readiness Checklist

Know what lenders will ask for — and upload everything in one secure place for easy access.

Credit Score Tips

Understand the score you'll likely need for approval — and get personalized tips to improve it.

Your score: 720

Good range for mortgage approval

Tip: Keeping your credit utilization below 30% could increase your score by 15-20 points.

Milestones & Notifications

Get updates when you're 25%, 50%, or 100% mortgage-ready so you always know where you stand.

Congratulations! You've reached 75% of your savings goal.

Only $11,250 more to go!

Next milestone: 90% of savings goal

Expected in 3 months

Built for First-Time Buyers in Canada

Whether you're just starting to save or you're almost ready to apply, we give you full visibility into the process — without the stress.

Tailored for US mortgage requirements

Our platform is specifically designed to meet US banking and mortgage regulations.

Your info stays secure and private

Bank-level encryption and strict privacy controls keep your sensitive information protected.

Personalized guidance

Get advice tailored to your specific financial situation and homebuying goals.

Simple steps to homeownership

Our straightforward process helps you navigate the path to buying your first home.

Create an account

Sign up in minutes and set up your secure profile to begin your homebuying journey.

Input your details

Enter your income, savings, and home price goal to create your personalized plan.

Track your progress

Monitor your mortgage readiness in real time with our intuitive dashboard.

Apply with confidence

Know exactly when you're ready to apply for your mortgage with complete confidence.

Colin's Mortgage Readiness Dashboard

Last updated: Today at 9:45 AM

Overall Readiness

On track for pre-approval in 6 months

Down Payment

Document Checklist

4 documents still needed

Savings Projection

Next Steps

Continue monthly savings of $1,875

Next contribution due in 12 days

Upload proof of employment

2 recent pay stubs needed

Complete credit score check

Free check available

Mortgage Pre-Qualification

Based on your current profile:

Estimated Purchase Price

$450,000

Down Payment

10%

Est. Monthly Payment

$1,950

Interest Rate

4.5%

We're with you every step of the way

Our support doesn't end when you reach your savings goal. We offer comprehensive services to help you through the entire homebuying journey and beyond.

Home Purchasing Assistance

Get expert guidance through the home buying process, from finding the right property to closing the deal.

- Property search assistance

- Offer negotiation support

- Closing process guidance

Financial Planning

Develop a comprehensive financial plan that accounts for homeownership costs and your long-term goals.

- Budget optimization

- Emergency fund planning

- Debt management strategies

Investment Help

Learn how to balance homeownership with other investment opportunities to build long-term wealth.

- Investment portfolio guidance

- Retirement planning

- Tax-efficient investing strategies

Mortgage Refinancing

Get expert advice on when and how to refinance your mortgage to save money or access equity.

- Rate monitoring

- Refinance timing optimization

- Equity access strategies

Insurance Planning

Ensure you have the right protection for your new home and financial future.

- Home insurance guidance

- Mortgage protection insurance

- Life and disability coverage

Ongoing Support

Access to advisors and resources to help you navigate homeownership challenges and opportunities.

- Regular financial check-ins

- Home maintenance guidance

- Property value monitoring

Our goal is to help you not just become a homeowner, but a successful one who builds wealth through property ownership and smart financial decisions.

What our users are saying

Hear from users in the US and Canada who have simplified their homebuying journey with HomeTrack.

Frequently Asked Questions

Get answers to common questions about HomeTrack.

Take Control of Your Homebuying Journey

Start saving, tracking, and organizing your mortgage process today — for free.

Be the first to know when we launch. No spam, ever.